Articles

The newest returnable area is meant to defense unpaid debts, damages, or unreturned property (including furnishing inside the a prepared flat). The animal put may be returned should your dogs doesn’t trigger one injury to the new apartment or surroundings. The better you are aware the brand new legal issues tied to shelter dumps, the higher chance you may have of finding your deserved portion of your deposit back.

Summertime online uk: Security Put: Everything you Landlords Should become aware of

- Income derived from the newest independent property of a single mate (and you may that isn’t made earnings, exchange otherwise company income, otherwise connection distributive show money) try handled as the earnings of the companion.

- Specific claims could possibly get award tenants over the new debated amounts, sometimes as much as 3X the security put.

- Utilize the a couple of examination described lower than to determine whether or not something away from U.S. supply earnings falling within the three groups above and you will gotten inside income tax 12 months is efficiently regarding the U.S. change otherwise organization.

- While in the 2024, Henry was not engaged in a trade otherwise organization regarding the All of us.

- To possess here is how to allege which exception out of withholding, come across Income Entitled to Taxation Pact Professionals, later.

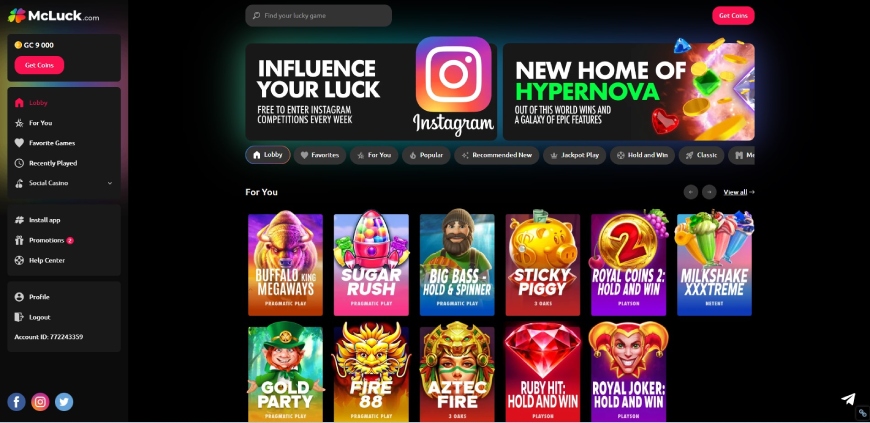

Resident position is recognized as for started recinded away from you if your You.S. Regulators items you a final administrative otherwise judicial purchase away from exemption summertime online uk otherwise deportation. A final official buy is your order that you may possibly zero lengthened interest a higher court of skilled jurisdiction. Gambling try an enjoyable hobby this is simply not intended to be put to own financial gain.

Other punishment can be assessed to have an installment returned by fiduciary’s lender for insufficient fund, accuracy-associated issues, and you can con. Fiduciaries which have an enthusiastic AGI from $150,000 otherwise reduced estimate the needed projected taxation to your less away from a hundred% of your 2020 12 months taxation, or 90% of one’s 2021 season income tax, as well as AMT. Fiduciaries which have an enthusiastic AGI higher than $150,000 must estimate their taxation according to the lesser away from 110% of the 2020 year taxation otherwise 90% of its 2021 year tax, in addition to AMT. Fiduciaries which have an enthusiastic AGI equivalent or more than $1,100,100000 must calculate the estimated income tax to the 90% of the 2021 season taxation, along with AMT. Generate all of the inspections or currency orders payable in the You.S. dollars and you will pulled against an excellent You.S. lender. FirstBank, having twigs in the Texas, Arizona, and you will California; has to offer a $three hundred extra for individuals who discover an excellent FirstBank Flower Bundle that have extremely effortless requirements.

Dive Agile Rent Guarantee Implement Today

Ted did on the U.S. work environment up to December twenty five, 2023, however, failed to get off this country up until January eleven, 2024. To your January 8, 2024, Ted acquired the last salary for characteristics did on the Joined Claims throughout the 2023. Each of Ted’s money while in the Ted’s sit here’s U.S. origin earnings. When you are an applicant for a qualification, you’re capable exclude from your own money area or all of the amounts you can get while the an experienced grant.

It may be revived and you may once 21 weeks it can also getting changed into long lasting house. Protect the newest economic stability of your own Condition and you can provide accountability inside a target and you can successful trend. That it Borrowing from the bank Relationship is actually federally-covered from the Federal Borrowing Relationship Management.We do business according to the Reasonable Homes Rules and you will Equal Chance Borrowing from the bank Work. Inquire about our very own repaired-rates Family Guarantee Fund and you can House Equity Lines of credit (HELOCs), which allows one borrow against the new guarantee of your home and also have the money you would like now. People who have provide tax things will be get in touch with competent taxation counsel, who can explain the considered potential which can occur in respect for the import from possessions from the provide.

To have information on the newest income tax remedy for dispositions of You.S. real-estate passions, come across Real-estate Get otherwise Loss of section 4. For individuals who act as a family personnel, your boss does not have to withhold tax. But not, you could commit to willingly withhold taxation because of the processing an excellent Form W-4 together with your employer.

Within the a well-known investigation, it had been found that 40 % away from People in america cannot started with the cash finance to handle a great $eight hundred emergency expenses. Which also form of numerous and discover shelter deposits as prices-expensive. Part of knowledge shelter deposits try being able far a landlord can be legitimately inquire about a safety put. If you think their prospective property manager is asking for an excessive amount of, here are a few the clients legal rights for the Roost or talk to a great regional housing recommend. Get into your own explore income tax liability on the internet cuatro of your worksheet, or if you commonly necessary to make use of the worksheet, go into the amount on line 34 of one’s income tax get back. If a last shipping from possessions was developed inside the year, the nonexempt income of the estate otherwise believe must be entered on the internet 18 since the shared with beneficiaries, no exemption borrowing from the bank is acceptance.

In the Paraguay, an individual is considered to be income tax-citizen if she or he uses more than 120 days a season in the united kingdom.Both income tax-citizens and you can non-people is susceptible to private income tax on the Paraguayan-resource income. Individual earnings are taxed at the ten%, when the earnings is equal to or more than simply 120 month-to-month minimal salaries, otherwise try taxed during the 8%. Returns is subject to a final withholding taxation during the an excellent taxation speed of five%. Investment progress, welfare and you will royalties try taxed from the standard rate.Property taxation are levied from the a-1% to your cadastral worth of the property. Surtaxes will get apply for the certain types of services.There aren’t any taxes to your heredity and internet worth.The newest V.A.T. fundamental rate try 10%. A good 5% reduced taxation speed applies to the supply from certain goods and you can functions.Of corporate income tax, resident organizations try subject to income tax on the money derived from Paraguay at the a flat speed out of 10%.

The lease will be in a position to respond to so it concern to own you. The safety deposit is meant to defense repairs and clean up will cost you. For many who don’t shell out your own rent, obviously, they’ll ensure that it it is to fund your rent. However you may end up with an additional statement for cleaning and fixes. Regulations are different, so you’ll want to remark your neighborhood tenant-landlord laws and regulations for more information.

Head put as well as prevents the chance that your own view might possibly be forgotten, taken, forgotten, or returned undeliverable on the Irs. Eight within the ten taxpayers play with direct deposit to get their refunds. For many who don’t provides a checking account, check out Internal revenue service.gov/DirectDeposit for additional info on finding a lender or credit connection that will open a merchant account on line. Once you end up being a citizen alien, you could generally no more claim an income tax pact exemption to own it earnings. Arthur Banking companies try a nonresident alien that is solitary and you can a great citizen away from a different nation who has an income tax pact with the usa. Arthur received revenues of $25,900 in the taxation year away from source inside the Us, composed of the next items.

Willow Valley Teams maintains a cig-totally free ecosystem. Puffing and/otherwise tobaccouse is strictly blocked anywhere to the Willow Valley Communities possessions, indoors otherwise away. Which policy try inclusive ofall cigarette smoking points, in addition to electronic cigarettes/vaping.

If you are an enthusiastic farming worker on the an enthusiastic H-2A charge, your boss shouldn’t have to withhold tax. However, your boss tend to keep back income tax as long as you and your workplace agree to withhold. Therefore, you must render your employer with an adequately finished Form W-4. You need to let your boss understand whether you are a citizen otherwise a good nonresident alien which means your boss is also withhold a correct level of taxation from your own earnings.

Credits

Instantly disperse and replace currency anywhere between Canada and also the U.S., put checks, pay bills and get away from foreign purchase charge. It’s versatility and you may self-reliance you just don’t see that have a Canadian You.S. dollar membership. Pay bills, transfer and you will receives a commission along with your You.S. checking account and routing matter due to online financial. Create the U.S. notes on the PayPalLegal Disclaimer (opens up in the popup)‡,Courtroom Disclaimer (opens up inside popup)39 membership to transmit currency in order to family and friends in the You.S.

In case your home otherwise believe claims multiple borrowing from the bank, play with Plan P (541), Area IV, Credits one Remove Taxation, to work the total credit matter. Total the fresh line b numbers of outlines cuatro thanks to 9 and you may outlines 11 because of 15, from Plan P (541), Area IV, and you may go into to the Setting 541, range 23. Attach Agenda P (541) and you may any necessary supporting times or comments to make 541. If the home otherwise trust is actually involved with a trade otherwise business inside the nonexempt 12 months, go into the dominating company hobby password placed on the newest government Plan C (Form 1040), Cash or Losings From Organization. A penalty try assessed in case your income tax go back are filed once the newest due date (along with extensions), except if you will find practical reason for processing later.